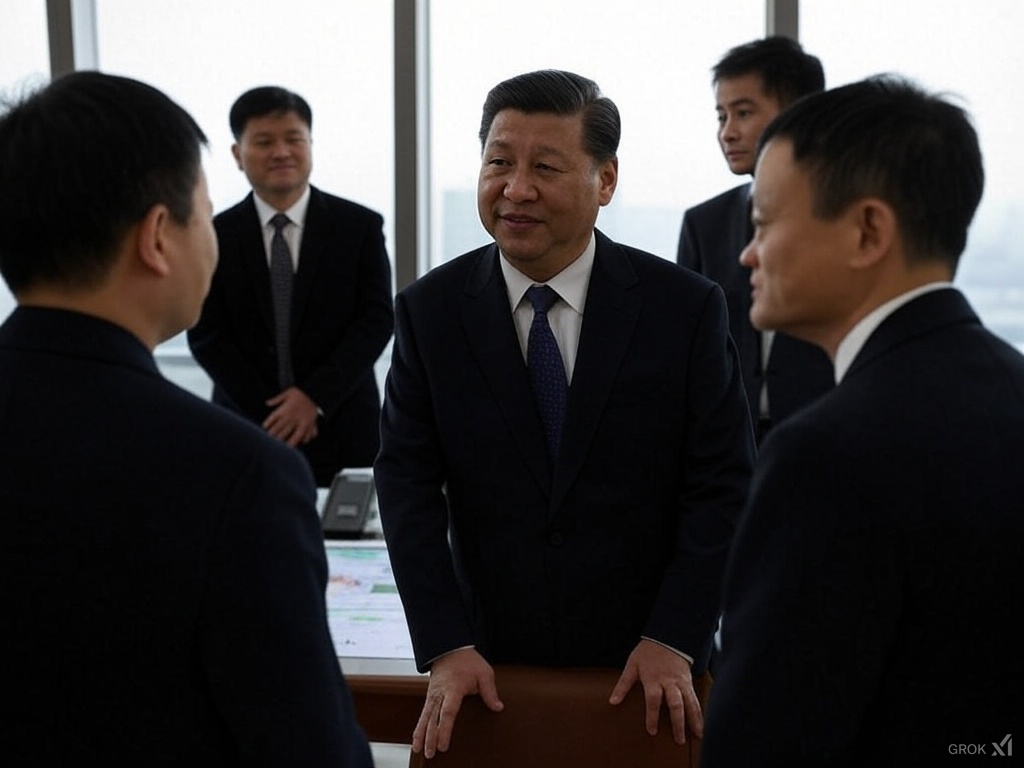

President Xi Jinping’s engagement with top tech tycoons signals an end to regulatory crackdowns while energizing Hong Kong’s stock market rally.

Could China’s renewed embrace of its tech giants be the catalyst for a broader resurgence within the BRICS framework? In a decisive display of shifting policy, President Xi Jinping met with China’s most influential tycoons—a move that many industry experts view as a clear departure from the stringent regulatory measures of recent years. This strategic pivot not only reignites investor confidence in China’s tech sector but also sets the stage for dynamic market growth across the BRICS nations.

Key Developments: A Turning Point in Policy

At a landmark meeting, President Xi Jinping signaled a policy transformation that many believe marks the end of Beijing’s rigorous regulatory campaign against the tech industry. The presence of prominent figures such as Alibaba co-founder Jack Ma underscored the administration’s renewed support for private enterprise. According to analysts at Morgan Stanley, the meeting sent a decisive message that the era of regulatory suppression is drawing to a close, a sentiment echoed by UBS’s wealth management unit, which anticipates sustained outperformance by major Chinese tech stocks.

In the months leading up to the meeting, China’s tech giants had already set the stage for a bull market, contributing a staggering US$245 billion surge to Hong Kong’s stock market capitalization. Investors have propelled companies like Alibaba, Xiaomi, and Tencent Holdings to multi-year highs—a trend further bolstered by breakthrough innovations from start-ups such as DeepSeek in the field of artificial intelligence.

Political Impacts and Outlook

From a political standpoint, President Xi’s meeting with these influential business leaders sends a powerful signal of governmental support for the private sector. The strategic engagement, reminiscent of similar meetings in November 2018, July 2020, and even as recently as May 2024, reflects an evolving approach to governance where market dynamics and regulatory policies are closely intertwined. By fostering an environment of optimism and stability, Beijing appears intent on recalibrating its role from a strict regulator to an active facilitator of economic growth, a move that could redefine regional alliances within the BRICS bloc.

Economic Impacts and Outlook

Economically, the effects of this policy shift are already palpable. Hong Kong’s Hang Seng Index surged by 1.6 percent to reach its highest level in four months, cementing its status as the best-performing major index globally this year with an overall gain of 15 percent. Market watchers have noted significant gains: Alibaba climbed 3.4 percent to hit a three-year high at HK$126.30, Tencent advanced 2 percent to HK$503.50—its strongest performance since July 2021—and Xiaomi surged 7.2 percent to record an all-time high of HK$48.40. The momentum, driven by robust performance among major tech players, underscores a vibrant market landscape that is attracting renewed interest from both domestic and international investors.

Quick Insights

- Policy Pivot: Xi Jinping’s meeting signals an end to the tech regulatory crackdown.

- Market Surge: Hong Kong’s stock market gained US$245 billion in capitalization this year.

- Tech Titans: Major players like Alibaba, Tencent, Xiaomi, and DeepSeek are reaching new performance milestones.

- BRICS Boost: The move bolsters investor confidence across the broader BRICS framework.

Global Regulatory Perspectives

In contrast to the cautious regulatory approaches observed in G7 nations, China’s decisive policy shift underscores a markedly different strategy—one that prioritizes rapid market recovery and technological innovation. This divergence not only highlights the unique dynamics within the BRICS group but also offers a comparative lens through which global investors can assess emerging market opportunities against established Western models.

Regional Spotlight: Hong Kong at the Forefront

As the financial nexus of Asia, Hong Kong emerges as the epicenter of this transformative wave. With its stock benchmark outperforming global counterparts, the city is poised to leverage these regulatory relaxations, drawing increased capital inflows and reinforcing its status as a premier hub for international finance and innovation.

What’s Next?

Looking ahead, industry experts speculate that continued policy easing could propel Chinese tech stocks to unprecedented heights. With key players poised for further expansion and innovation, the momentum generated by this landmark meeting may well extend its influence across the entire BRICS network. Investors and policymakers alike will be watching closely as the interplay between regulatory reform and market performance sets the stage for the next chapter in this unfolding economic drama.